trade life cycle steps

Front office function Risk management and order routing. Before going into the details of the trading events let me explain how a trading deal is being struck between two entities.

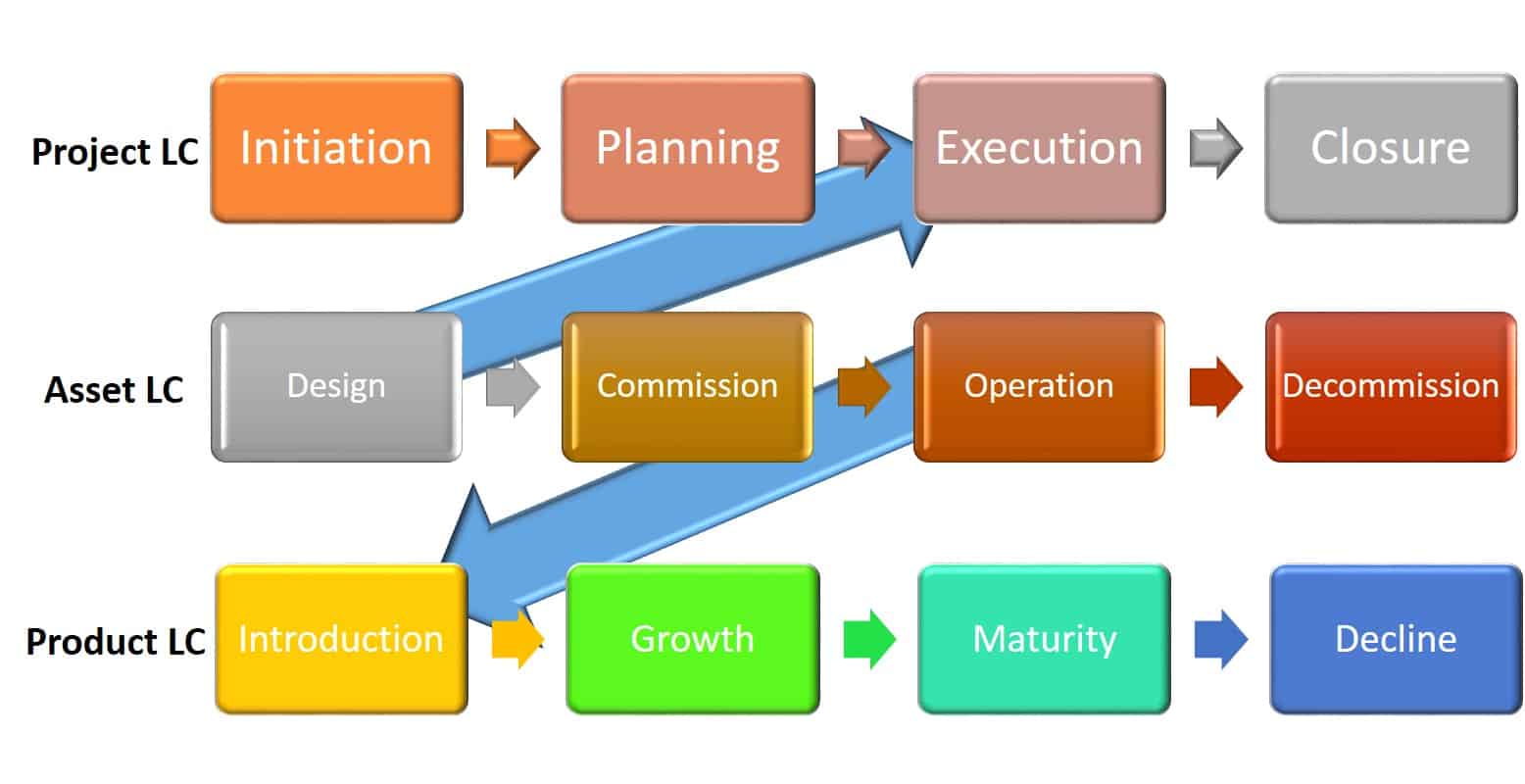

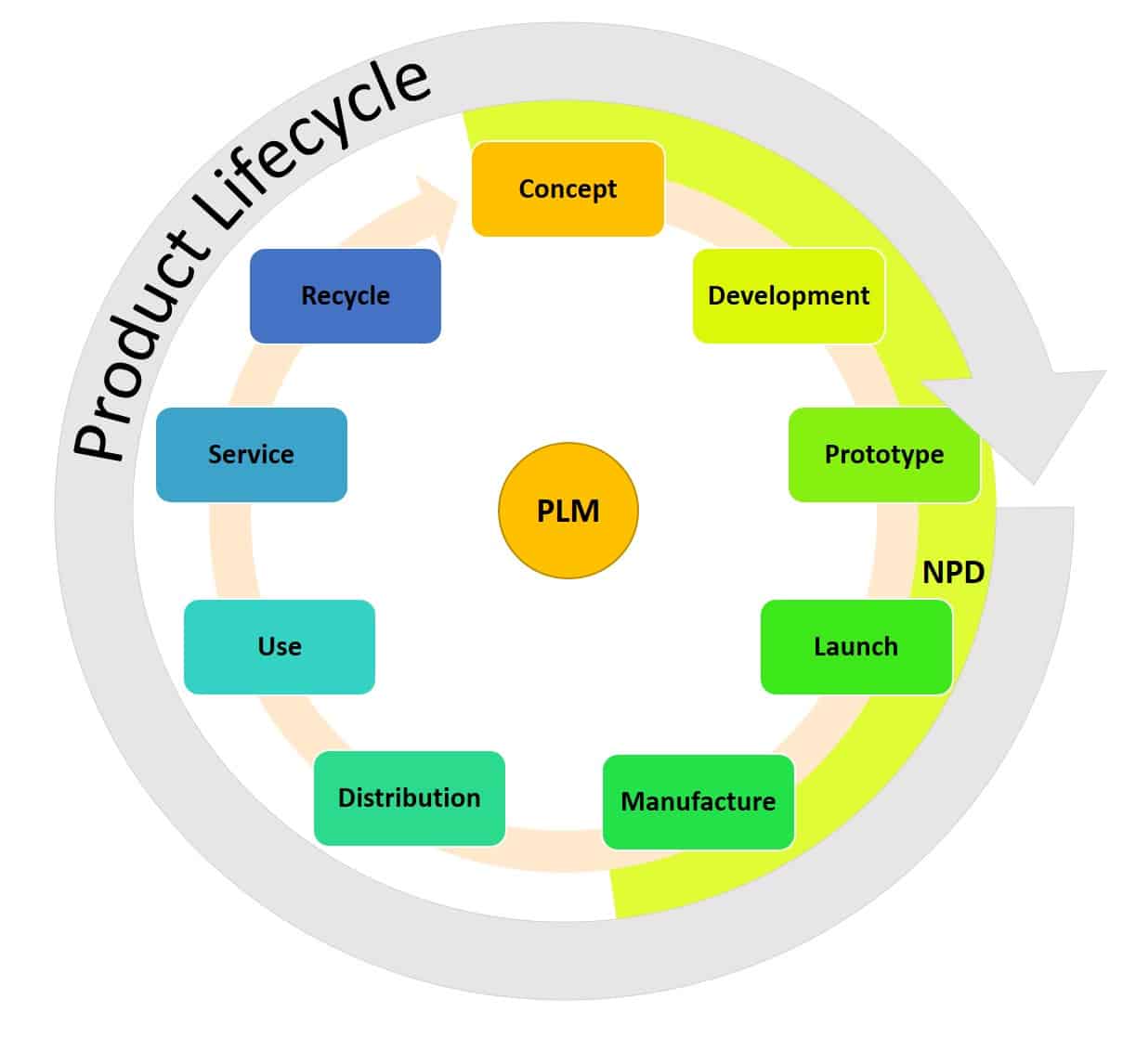

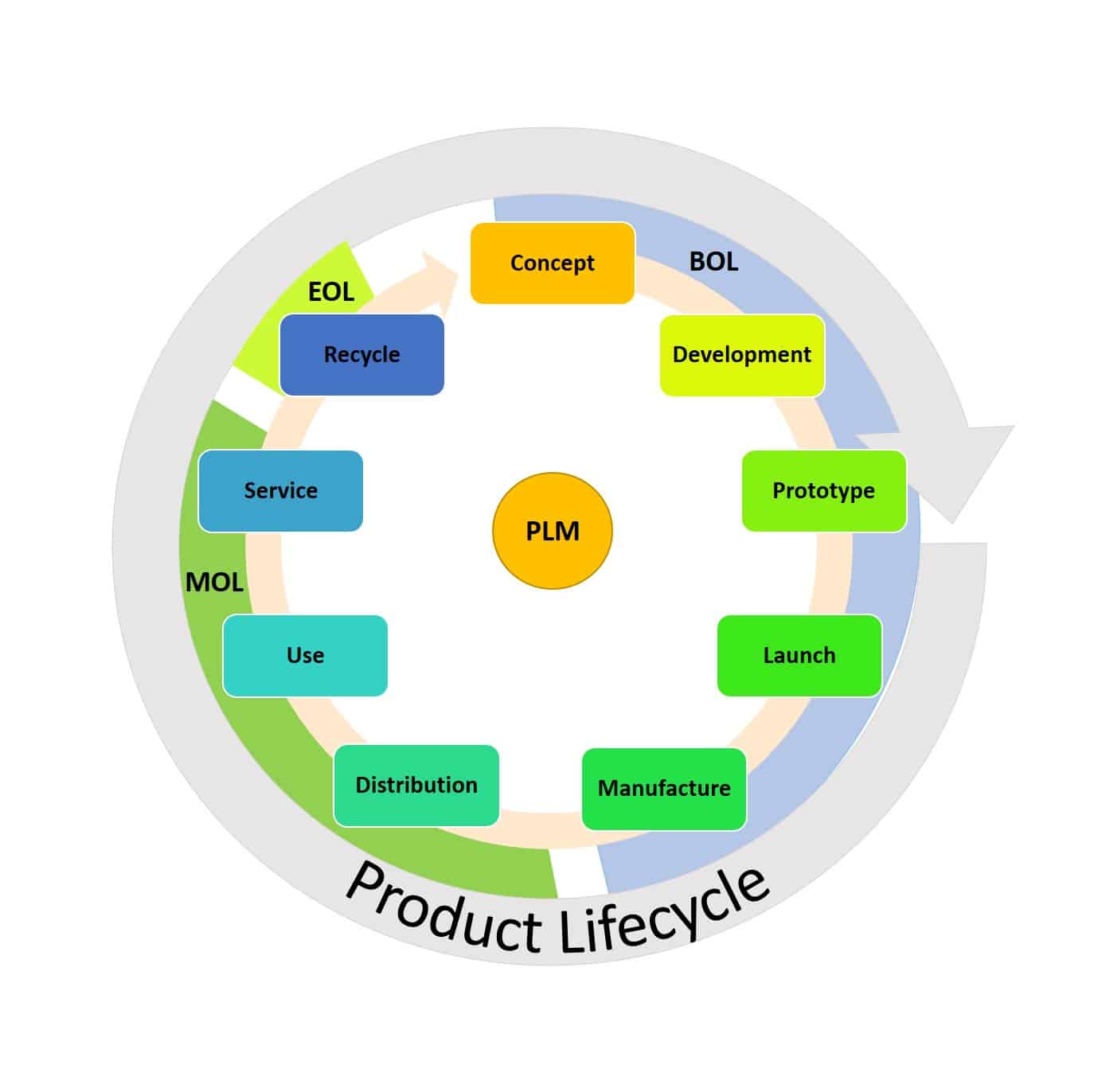

Ultimate Product Life Cycle Management Guide Smartsheet

Risk management and order routing.

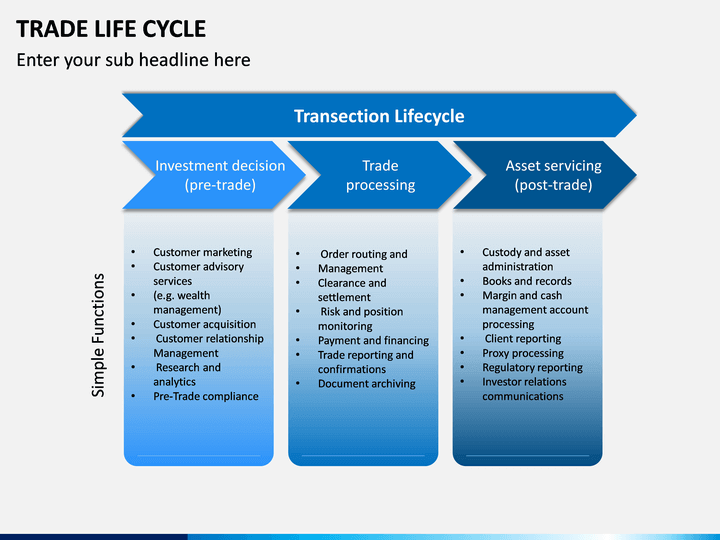

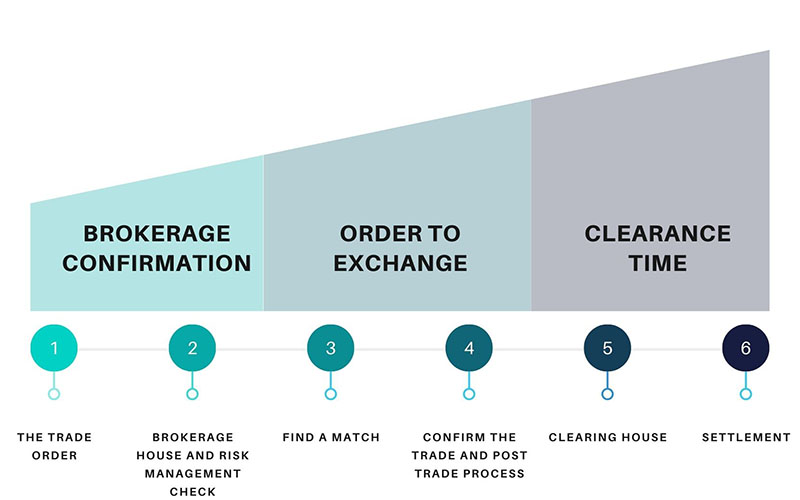

. At this point the buyer and the seller compare trade details approve the transaction change records of ownership and. The entire Life Cycle of a trade can be broken down into pre-trade and post-trade events. Common domain model CDMthe value proposition.

In buying and selling shares by the investor the broker places a query to. The trade ends with the settlement of the order placed. Order Matching and.

Sale - This is a process of client acquisition in which HNIs or Institutional clients are introduced to various. Risk management and order routing. Trade Validation and Enrichment.

Order initiation and delivery. Up to 5 cash back The trade lifecycle can be regarded as a series of logical steps which are represented in Figure 101 however it should be noted that some of these steps can occur in parallel or in a different order to that stated. Front office function 2.

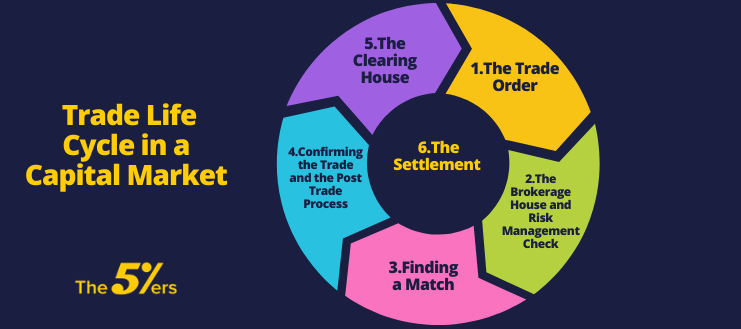

The Trade Life Cycle Account Reconciliation. The following 11 chapters beginning with Chapter 11 and ending with Chapter 21 focus on each major step in the trade lifecycle. Account reconciliation occurs at the end of the trade settlement process to ensure that a trade has settled properly and that all expected cash flows have occurred.

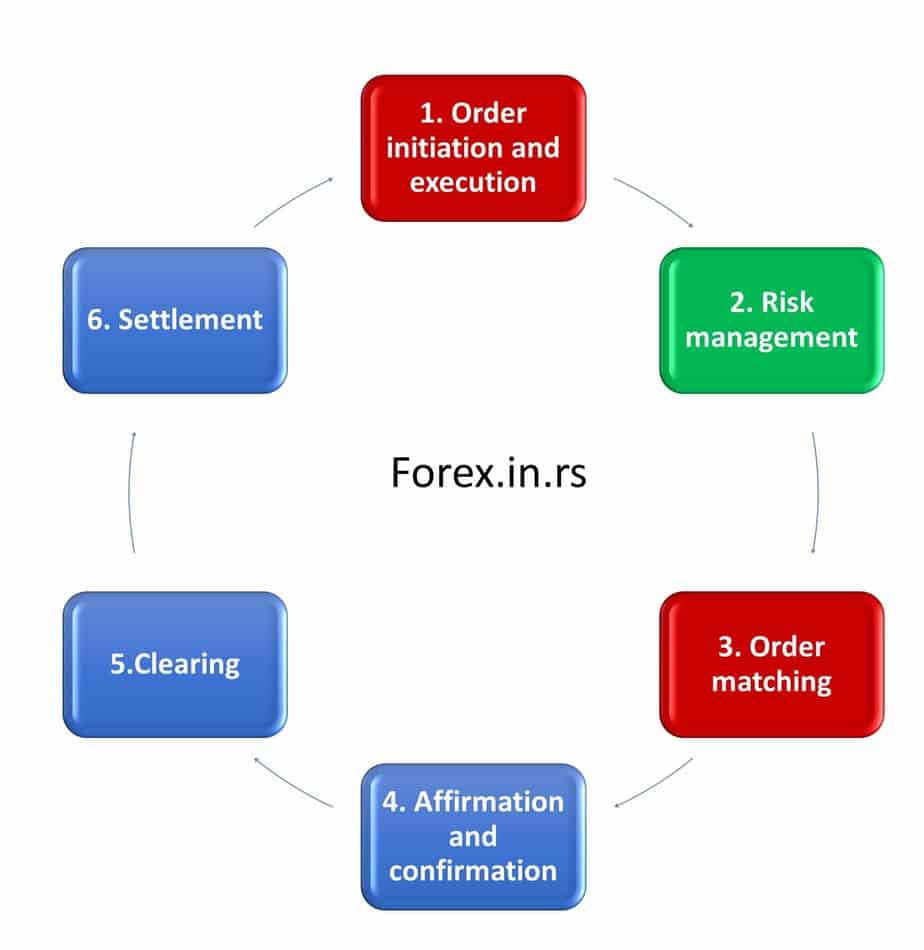

Trade whether it is exchanging goods and services or if it is done as a medium to exchange financial instruments- the purpose is the same the implication on it is same - to create something of valueStages involved in the trade life cycle are. Investor places an order. Order initiation and delivery.

Trade Initiation and Execution. Trade Life CycleSecurities trade life cycle 1. What Is the Trade Life Cycle Process.

Order Initiation and Delivery. Front office function 4. The trade life cycle is a series of steps taken to buy sell or trade securities.

Trade life cycle in Capital Markets 1. Front office function 2. This data can be added manually however in the STP environment the aim is to derive this automatically.

Lets Find a Match. The main idea behind any trade is the profit that one generates within a stipulated. Front office function 4.

Below mentioned are the important steps. Back office function 5. Trade Life Cycle From the Trade Origination to the Settlement Trading Trade Origination Order Origination Trade Execution Operations Trade Validation Trade Confirmation Clearing Settlement.

All the steps involved in a trade from the point of order receipt where relevant and trade execution through to settlement of the trade are commonly referred to as the trade. Post-trade processing occurs after a trade is complete. Middle office function 3.

Time-saving market tested algorithm designed for an edge in the market. Risk Management and Order Processing. A similar process occurs when you call your broker to place a trade.

This blueprint will deliver common standards for data formats reference data transactional data and business processes. Trade Life Cycle. The Trade Life Cycle mainly divided into two parts.

Equity trade life cycle is nothing but the stages involved in trading the equity financial instrument. Our infographic walks you through five key steps in the lifecycle of an online trade. To explain it further a trade is the conversion of an order placed on the exchange which results in pay-in and pay-out of funds and securities.

Confirming the Trade and the Post Trade Process. Companies should use a front office in the trade life cycle as well as back and middle office functions in trade life cycles. Investment Banking Trade life cycle.

Trade Initiation and Execution This is the process of placing an order in the market. Order initiation and delivery. We know that one of the primary usages of derivative contract is to hedge the risk.

Middle office function 3. This means that the back office should site the debits and credits in the NOSTRO accounts. Stage 1 - The investor informs the broker firm and their custodian a financial institution usually a bank which looks after their assets for safekeeping of the security they would like to buy and at what price either the market price or lower.

Order matching and conversion into trade. When you enter an order to buy or sell securities your order is sent over the Internet to your brokerage firmwhich in turn decides which market to send it to for execution. Each entity helps ensure that all regulatory and risk mitigation protocols are followed.

Order matching and conversion into trade. Trade Life Cycle From the Trade Origination to the Settlement Trading Trade Origination Order Origination Trade Execution Operations Trade Validation Trade Confirmation Clearing Settlement. The Order Makes its Way to The Exchange.

Below are the important steps involved in trade life cycle. Every trade has its own life cycle. In October 2017 the International Swaps and Derivatives Association ISDA introduced its CDM to create a standard blueprint for an end-to-end post-trade lifecycle.

Below are the important steps involved in trade life cycle. Risk management and order routing. The Brokerage House and Risk Management Check.

Ad Improve performance with simplified signals on technical patterns. Order initiation and delivery. After trading negotiations between seller and buyer an order is placed and the trade is executed.

Middle office function Order matching and conversion into trade. Marketing persons from investment banks brokers and dealers introduce various financial products and. Risk management and order routing.

Trade Capture - Trades are. Front Office Order Origination Orders are received from Clients Received by Sales Trader -By Phone -Electronically New Orders are entered into Order Management System This step is referred as Trade Capture. Front office function Affirmation and confirmation.

To understand trade life cycle we need to understand detailed steps involved in trade life cycle. Below are the important steps involved in trade life cycle.

12 Trade Enrichment Securities Operations A Guide To Trade And Position Management Book

Trade Life Cycle In Capital Market Forex Education

Trade Life Cycle Powerpoint Template Sketchbubble

Product Management Lifecycle Infographic Product Focus

Ultimate Product Life Cycle Management Guide Smartsheet

Introduction To The Trade Life Cycle Knoldus Blogs

12 Trade Enrichment Securities Operations A Guide To Trade And Position Management Book

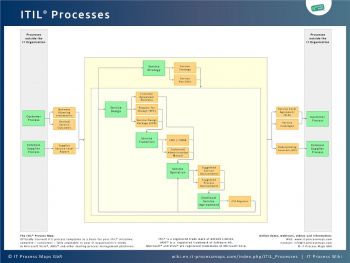

Itil Processes It Process Wiki

:max_bytes(150000):strip_icc()/BuildaProfitableTradingModelIn7EasySteps2-93ba242cb2e3443a8a846ed36c92867f.png)

Build A Profitable Trading Model In 7 Easy Steps

The Trade Life Cycle In Capital Market Overview The 5 Ers Forex Blog

Systems Engineering Life Cycle Processes As Applied To Systems Of Systems The Mitre Corporation

Check Out The Life Cycle Of Financial Planning Process Via Secure247trade Financial Planning Finance Saving Insurance Marketing

Ultimate Product Life Cycle Management Guide Smartsheet

An Overview Of The Itil Service Lifecycle Modules

Overbond Academy Fixed Income Market

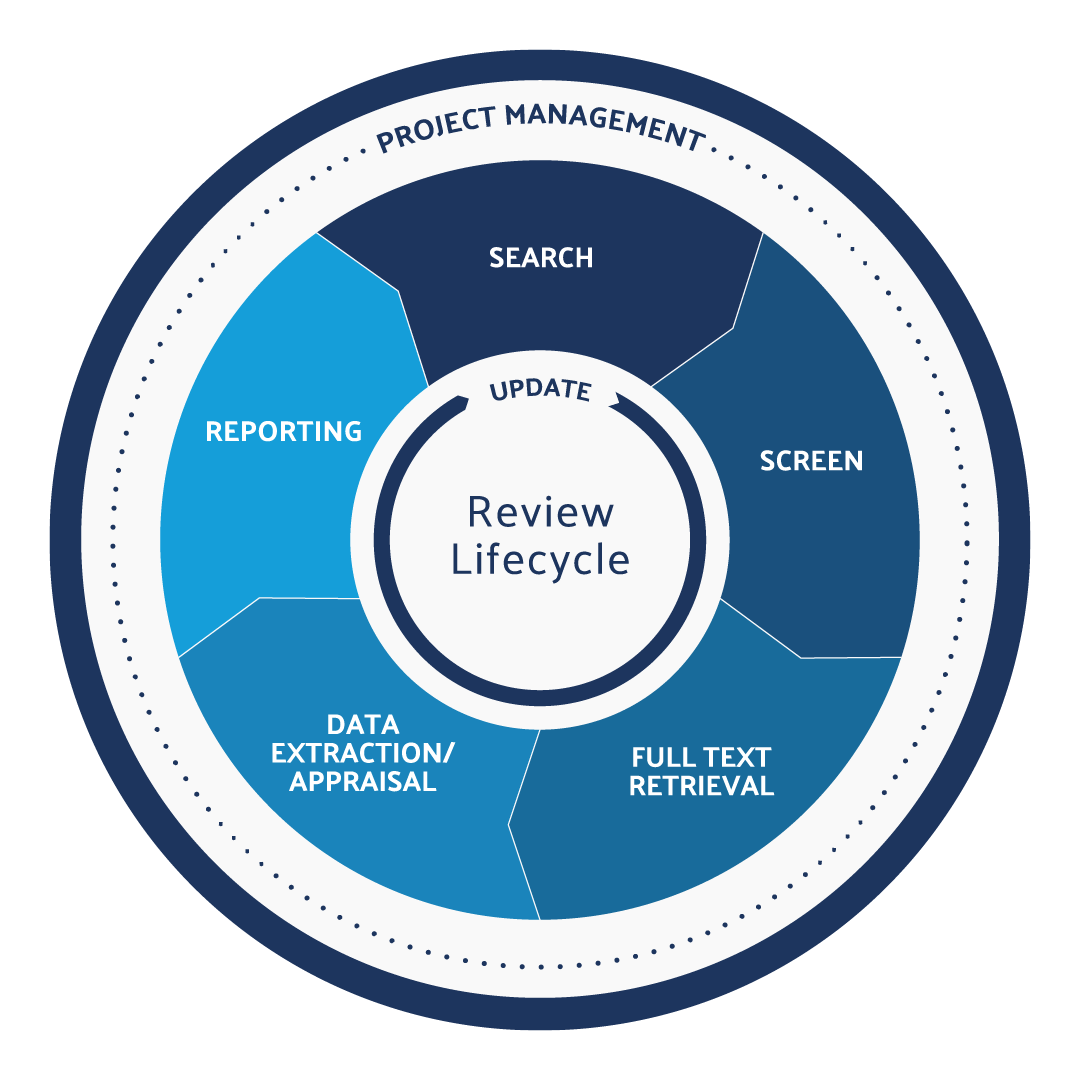

How Literature Review Automation Improves Cer And Per Program Management Distillersr

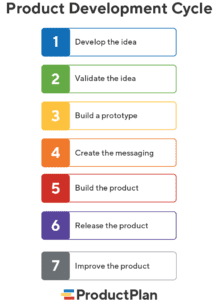

What Is The Product Development Cycle Definition And Overview

Chapter 11 Securities Lending Borrowing And Collateral The Sl B Trade Lifecycle Collateral Management Book

The Trade Life Cycle In Capital Market Overview The 5 Ers Forex Blog